Valuating Amazon's Big Move Into Automotive Data Monetization

It is estimates that the overall revenue from car data monetization at a global scale could add up to USD 450 to 750 billion by 2030.

I believe that Amazon recognized this value early on and is addressing the need for a platform that meets the needs.

A very conservative calculation shows that Amazon's sales in the cloud will double solely as a result of automotive monetization.

The highly profitable cloud business is not at all affected by the antitrust concerns. This gives investors a lot of security with regard to possible interventions.

Introduction

Amazon (AMZN) is currently struggling with a lot of news about battles with competition authorities and disappointing quarterly results. I myself have spoken bearishly about the company several times. I'm still very skeptical about Amazon's dominant market position and the company's practices. For my scepticism about the economic network effects of the business model, I was often attacked by investors in the commentary section of my article. According to the quarterly figures, however, it suddenly appears as if the wind has turned.

Given that, one threat does not necessarily weigh as much as another threat. To evaluate the risk of an investment, Investors have to perform very thorough due diligence. In view of the current sentiment, I would like to point out a mega chance for Amazon that lies in the monetization of data in the automotive sector.

Amazon's Automotive Cloud

I have always explicitly excluded the cloud business from my negative scenarios in my former analyses. While other analysts are now also increasingly negative about the company and the high P/E ratio, it could be overlooked that the world continues to turn and that technical progress is also proceeding in favor of Amazon's cloud business. Hardly noticed by investors, something trend-setting has happened in Europe, which will appeal to a few companies. Amazon is one of them. In the following I will explain why this is the case. But first we should look at Amazon Automotive Cloud service. Amazon's cloud service AWS provides services for the Automotive industry to enable the digital transformation at every point of the value chain.

(Source: AWS for Automotive - Amazon Web Services)

Hardly noticed by investors, the EU member states stopped a new Wi-Fi standard for autonomous driving in the EU. The planned Wi-Fi standard was rejected by a qualified majority of 21 states. This sets the course for the 5G standard in Europe and shows that the time of talk is gradually over, and the implementation of the first 5G applications is now imminent. Amazon will benefit extremely from this, because now a political support of 5G applications is to be expected. Overall, I believe that Amazon recognized a mega trend early on and is addressing the need for a platform that meets the needs like no other company.

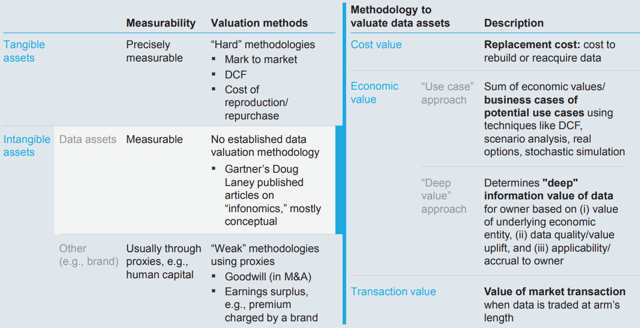

Assessment of value

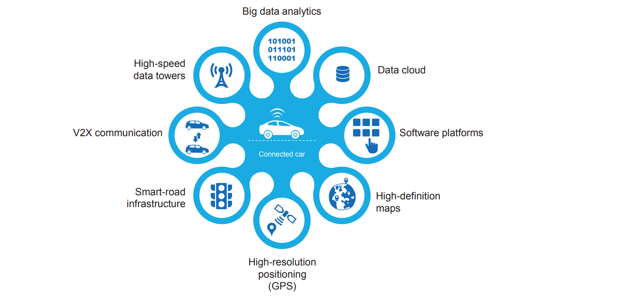

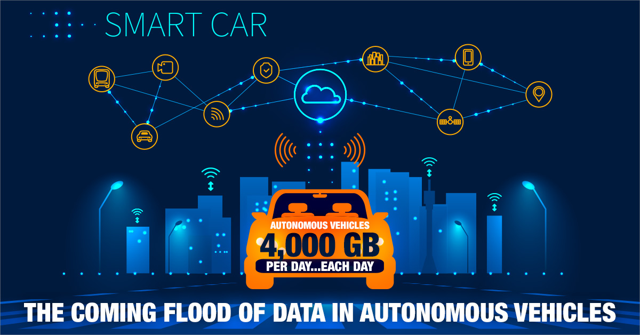

The future of automotive is determined not only by robotics and artificial intelligence, but also by connecting cars with their surrounding. V2X or the communication between vehicle and everything is a form of technology that allows vehicles to communicate with moving parts of the transport system. V2X consists of several components: Vehicle-to-Vehicle (V2V), Vehicle-to-Road (V2R), Vehicle-to-Infrastructure (V2I), Vehicle-to-Network (V2N) and Vehicle-to-Person (V2P). These connections generate an extremely large amount of data. One car alone generates 4,000 GB data in one day. This flood of data must of course have a value. Since data is a relatively new appearance of intangible assets, it is not always easy to calculate the value of data. There are essentially three approaches. You can determine the value of data once according to how expensive it is to create or reacquire it. Another methodology to valuate data assets is to sum op use cases via computations (discounted cash flow, stochastic simulation etc.). Furthermore, investors can assess the value of data assets by the transaction value of data trades.

(Source: Valuation of data)

To see how valuable data will be in the automotive sector, just take a look at the technologies with which cars will be networked in the future. According to a study by McKinsey, eight different infrastructure technologies will enable car data monetization:

(Source: Key infrastructure technologies)

In accordance with the "use case" approach, it becomes clear here how many different application areas will create and use data in the automotive sector. This generates this extremely large amount of data of 4,0000 GB per day (each day, see above). This data must be managed, calculated and distributed. Furthermore, a system is required that allows the respective data subjects access to the data. Conversely, it must be ensured that unauthorized persons do not have access to the data. This is accompanied by the need for sufficient security mechanisms to protect the data against sabotage, falsification, theft and deletion. Of the key technologies, three aspects are particularly important for this area.

- Data cloud: Connected cars generate a massive amount of date. To have access to these data, Data cloud acts as the remote repository.

- Software platforms: This platforms will support the operating systems, app store, and payment systems of the car data infrastructure.

- Big data analytics: To process the large amounts of data generated by connected cars on the road in real time big data analytics is required.

Given that it is estimates that the overall revenue from car data monetization at a global scale could add up to USD 450 to 750 billion by 2030, these three areas will occupy key positions as they are at the heart of car networking. This is where all the data obtained comes together, there are entries of data and exits of data. Hence, with the coming flood of data in autonomous vehicles will come a flood of money.

(Source: The coming flood of data)

Implication for Amazon

Amazon has positioned itself with regard to the three key technologies. With the cloud, it offers not only the possibility of storing data, but also analysis. The cloud also supports deep learning, which is particularly important in the area of autonomous driving. In addition to traditional car companies like BMW (OTCPK:BMWYY) and AUDI (OTCPK:AUDVF), Lyft (LYFT), Uber (UBER), Grab (GRAB) and Ola (OLAC) are all customers. So Amazon is already there where many providers still want to go. Volkswagen (OTCPK:VWAGY; OTCPK:VLKAF), for example, is still working with Microsoft (MSFT) on its own cloud system.

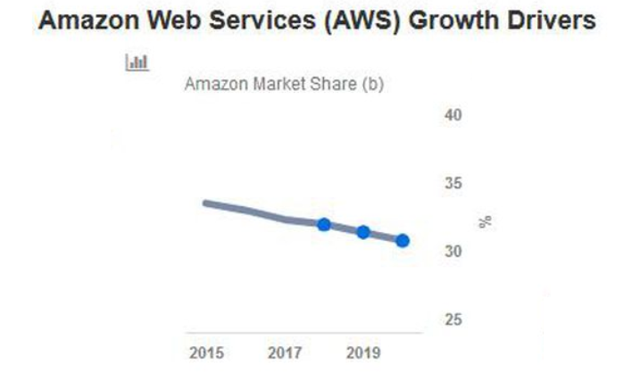

In the last quarter, Amazon's cloud revenues grew 37.7 percent over the year to USD 8.38 billion (missing the analyst estimates of USD 8.5 billion slightly). What's really impressive is the margin. In the last quarter, Amazon's cloud business generated an operating income of USD 2.1 billion.

In order to make a qualitative statement about the financial opportunities, Amazon's market position is decisive. Over the last three years, Amazon's market shares have remained in the 32-33% range.

(Source: Amazon's market share in the relevant cloud market)

It should also be noted that Amazon is only active in some areas of Automotive data monetization (data cloud, software platforms and big data analytics). The expected revenue of up to 750 billion euros by 2030 will therefore cover more than these three areas. If one conservatively assumes a turnover of only 150 billion dollars per quarter in 2030, which is distributed evenly over the eight areas of data monetization described above, then the following calculation results for Amazon.

- USD 150 billion / 8 = USD 18.75 billion per data monetization segment

- USD 18.75 billion * 3 (Segments in which Amazon operates) = USD 56.3 billion

- USD 56.3 billion * 30 % (market share) = USD 16.9 billion revenue per quarter

This conservative calculation shows that Amazon's sales in the cloud business will double solely as a result of automotive monetization in the next decade. If one takes the same margin as now, then the operating profit only from the automotive cloud segment would rise to USD 4.2 billion per quarter(!). This is inconceivable from the current point of view, but shows the potential of this mega market. So if Amazon can maintain its market share, investors in the cloud business are facing golden times.

Taking regulatory risks into account for Amazon

Personally, I consider the possibility of regulatory measures against Amazon to be quite high, regardless of whether I consider them to be right and reasonable or not. Nevertheless, I have a pretty concrete approach to such threats. Given that one threat does not necessarily weigh as much as another threat, investors have to perform very thorough due diligence. The decisive factors are the business models and how these business models would react to antitrust regulation. When it comes to the investigation of the European Commission, a fine is possible. However, this fine will only be a one-time charge. A fine will considerably hurt the profit for one year, but beyond that, it will have no further effect. As far as the FTC, DoJ and German Federal Cartel Office investigations are concerned, I still believe that Amazon's business model is relatively susceptible to regulatory intervention. This is due to the fact that Amazon's success and all of today's business (except the cloud business) is built on economic network effects: The more customers make purchases on Amazon, the greater the incentive for third-party sellers to also use Amazon as a platform. This attracts even more customers and gives Amazon the power to establish new services etc. I see a danger that regulatory measures could lead users to turn away from Amazon. The same effects that led to Amazon's growth would therefore be reversed.

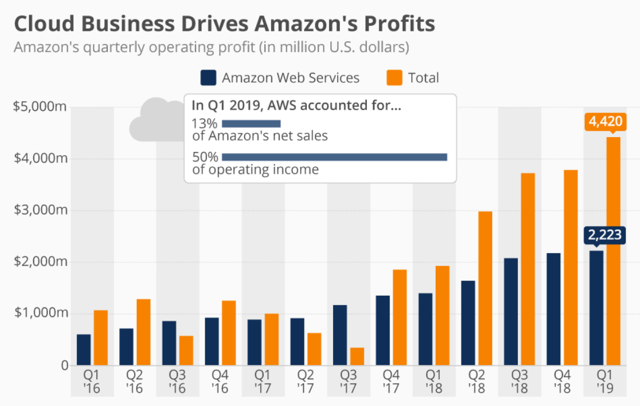

With regard to the cloud, however, this view should be put into perspective. As the following chart illustrates, Amazon's profit has largely been driven by its cloud business in recent years. Amazon Web Services (AWS), the leader in the highly competitive market for cloud infrastructure, accounted for more than 50 percent of the company's operating profit in the past quarter, despite contributing only 13 percent to the company's net sales.

(Source: Cloud Business Drives Amazon's Profits)

This highly profitable area is not at all affected by the antitrust concerns. This gives investors a lot of security with regard to possible interventions. Does this development justify such a high P/E ratio? I don't know. The market thinks that this is the case and the market is usually smarter than the individual investor. In any case, this analysis shows that Amazon knows how to position itself prematurely in future mega trends. It could well be that in future the cloud business will also make up the largest part of the business in terms of net sales. From this perspective, fears of regulatory intervention in the rest of the business could fade.

Investors Takeaway

The investor's key takeaway is that the time of talk is gradually over, and the implementation of the first 5G applications is now imminent. The automotive sector will have a significant share in this mega market and will make up an important part of the market volume. Amazon has already positioned itself in this mega future market and has strong partners at its side. Furthermore, the highly profitable cloud business is not at all affected by the antitrust concerns. This gives investors a lot of security with regard to possible interventions.

If you enjoyed this article and wish to receive updates on my latest research, click "Follow" next to my name at the top of this article and check "Get email alerts".

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

沒有留言:

張貼留言